Electricity Tariff Judgement Threatens N300bn Banking Loans

Kunle Aderinokun in Lagos and Chineme Okafor in Abuja

Palpable anxiety appeared to have pervaded the financial sector following the judgement of the Federal High Court in Lagos, which annulled the recent increase in electricity tariff. At over N300 billion, the total banking sector loan exposure to the power sector is at high risk as deals and contracts predicated on the new tariff regime are now seriously threatened.

A Federal High Court sitting in Lagos had last Wednesday gave a ruling which proscribed the existing tariff structure used by the 11 electricity distribution companies (Discos) to bill their consumers for electricity services to them.

Though Nigerian Electricity Regulatory Commission (NERC) has appealed the ruling and filed for stay of execution, fears have gripped operators in the financial sector and the power sector as a result of the judgement, which would also adversely affect electricity supply to residential and industrial consumers.

While the figures for the banking loan facilities extended to the power sector as at the 2015 financial year were not readily available, some of the banks’ 2014 full year results showed that a significant portion of their loan portfolios was offered to the electricity operators.

THISDAY checks revealed that United Bank for Africa Plc’s audited results for 2014 showed that lending to the power sector stood at N83.601 billion in 2014 while First City Monument Bank’s full year results for 2014 revealed that its lending to the power and energy sector in the year was N25 billion. Besides, in same year, Fidelity Bank Plc’s lending to the power sector gulped N58 billion in the bank’s loan book whereas Skye Bank Plc’s loan book showed that it lent N19.358 billion to the power sector.

Also, Sterling Bank’s full year results for 2014 showed that the bank committed N13.743 billion as loans to the power sector even as Union Bank Plc and Diamond Bank Plc granted a total of N23 billion and N50.8 billion, respectively to the power sector.

Apart from the foregoing, THISDAY checks also revealed that local and international investors that participated in the string of acquisitions in the oil and gas sector between 2010 and 2015 as well as the takeover of assets created from the defunct Power Holding Company of Nigeria (PHCN), raised over $11.6 billion from banks to acquire these assets. The investors staked about $2.929 billion to acquire the assets of the PHCN under the federal government’s privatisation programme.

NERC introduced a new electricity tariff under the Multi-Year Tariff Order (MYTO) 2015, with effective from February 1, 2016, which abolished fixed charges and increased the tariff by a maximum of 45 per cent.

With the new tariff structure, residential customer category (R2) in the Federal Capital Territory, Nasarawa, Niger and Kogi states, served by the Abuja Electricity Distribution Company (AEDC) franchise, who previously paid N14 per kilowatt/hour, are expected to pay N23.60 per kilowatt/hour.

Also, residential customers in Eko and Ikeja electricity distribution areas will be getting a N10 and N8 increase respectively in their energy charges. The same situation applies to residential customers in Kaduna and Benin electricity distribution companies, who are expected to experience an increase of N11.05 and N9.26, respectively, in their energy charges.

Explaining the implication of the review, the then NERC Chairman, Sam Amadi, said the new tariff was actually a reduction of what consumers ought to be paying before the commission froze tariff increase for residential consumers.

While the Wednesday judgment delivered by Justice Mohammed Idris has reversed the increase, declaring it illegal, NERC led by its acting Chairman, Dr. Anthony Akah, has appealed the judgement.

Commenting on the ruling, a highly-placed industry sources, who lamented that the annulment would be detrimental to the power sector and the economy in general, said there was no basis for it.

The sources also pointed out that banks that hitherto were enthusiastic about investment in the power sector and had secured deals based on the new tariff regime would now shy away from such deals.

For instance, the banks that have concluded arrangements to build the Qua Iboe power plant in Akwa Ibom State may no longer proceed with the project as it would no longer be profitable for them to do so.

Besides, sources also revealed that two other major power projects may be stalled since they were predicated on the annulled tariff by the recent ruling of the Federal High Court. It was gathered that one of the projects recently approved was First Power, being promoted by Chief Dapo Abiodun, and the other, a solar power plant, involved the International Finance Corporation (IFC).

More importantly, it was gathered that power shutdown was imminent in the industry as there would be huge revenue shortfalls for the distribution companies (Discos) and the federal government, which has already been affected by dwindled revenue, would not be in a position to cater for the shortfalls.

Industry sources further revealed that with the current cost components of their operations, if the Discos are not making money, they would have to be forced to close shops and the resultant effect would spell doom for electricity consumers.

In fact, THISDAY learnt that the current dip in revenue in the privatised electricity market would be exacerbated by the ruling.

THISDAY also gathered from an industry expert that the sector would be hard-hit by the judgement because its revenue generation profile was already on a very poor status, and this could make it worse.

The expert, who is privy to the internal workings of the sector’s finances, said that at the moment, the electricity market was in a dire financial situation, and will hardly withstand the new threat which he said the court ruling posed.

The expert also said the Discos were currently doing just about 28 per cent of their monthly remittances to the market instead of 100 per cent as agreed in the tariff, adding that an average of N20 billion existed as current monthly revenue deficit in the market.

This claim of such huge monthly revenue shortfall was in addition to a historic revenue shortfall figure which the Discos said was over N300 billion and yet to be closed.

The Discos’ representative, Sunday Oduntan, confirmed the N300 billion historic revenue shortfall to THISDAY.

Analysts are of the view that with the judgement, Discos would not charge cost reflective tariff from which generation companies and gas suppliers would be paid for their services to the sector.

That is going to be a tough one on the sector, analysts posited.

Speaking further on the court decision, analysts maintained that if the ruling stands, the market will either pack up or be bailed out by the government, an option that may not be practicable.

“The first thing to note is that it is unfortunate that after several years of NERC’s engagement stakeholders to enlighten them on power sector reforms and the Act, a decision collectively agreed upon was annuled.

“One thing that is very clear and should be made abundantly clear to everyone including the legislature is that without cost reflective tariff which is actually part of the Act, the industry will suffer or government will still have to dip hands into its pocket to support it.”

A major player in the industry who pleaded anonymity said: “It is rather unfortunate that such an outcome will come from the suit. If you inject up to 8000MW, maybe we will not feel the impact but at the level we are, this is definitely going to hit the finances of the industry.

“I also think it is going to be another excuse for the Discos not to pay the Gencos, this is a very bad development. The last time I checked on remittance it was just an average of 28 per cent compliance with payment. The shortfall has been up to N20 billion every month for a while now.”

Stressing that the judgment was not in the interest of the sector, he also noted that the Discos were also guilty of breaching service rules and challenging NERC’s powers to enforce compliance.

“I recognise that participants are running to the court for everything – you have the same distribution companies who went out to seek an injunction on NERC’s regulatory powers, and now they are coming out to shout that this is wrong whereas they were at the court at a time to undermine the powers of the regulator.

“I would have thought that there should be an engagement with the regulator; operators and consumers to find a balance. The Discos are right to say they cannot give what they don’t have but I don’t think that is alright because at times they ask for what they have not given – they give bills for what they did not supply,” he added.

SPONSORED LINKS

[TRENDING SONG!!] Romani D-Fans – Bestie (Prod By Krizbeatz)

[TRENDING MIXTAPE!!] DJ Baddo – Bestie Unlimited Mix

[TRENDING SONG!!] TYSG Ft Bad Mz X Kendi Rozzi – Iyariya

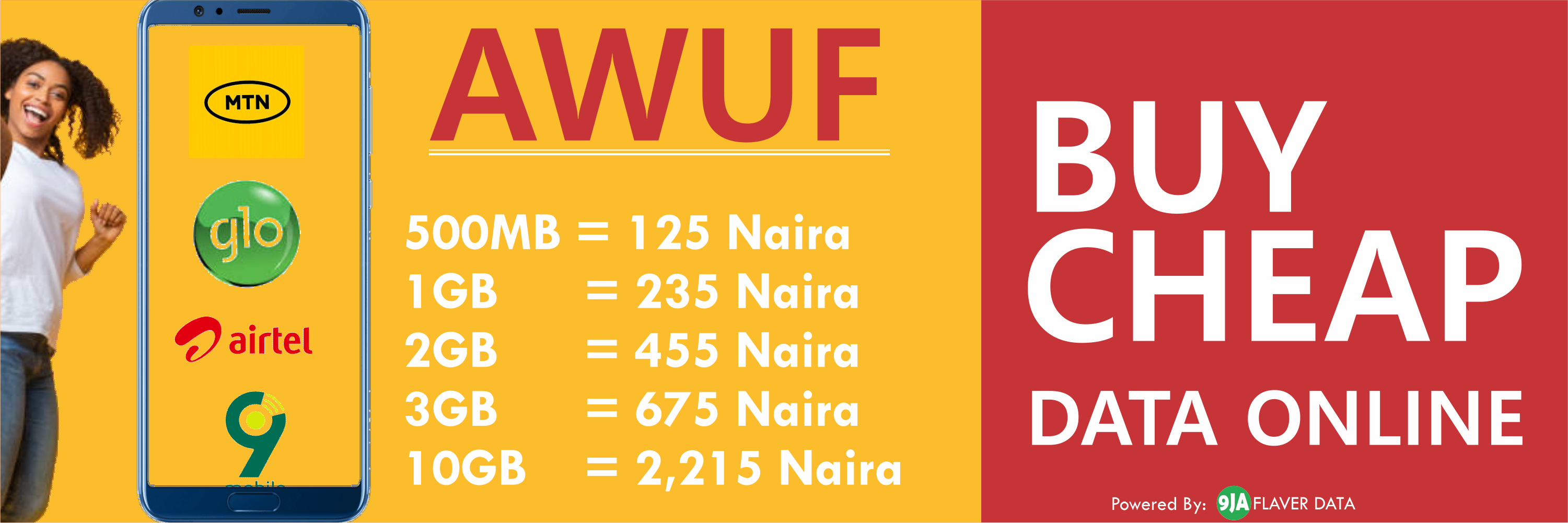

INSTALL 9JAFLAVER MUSIC APP, STREAM, DOWNLOAD, AND PLAY MUSIC OFFLINE

CHECK OUT FUNNY PICTURE AND MEME HERE (CLICK HERE)

Chissom Anthony – Glory To God In The Highest [See Trending Gospel Song]

© 2014-2023 9jaflaver. All Rights Reserved.

About us | DMCA | Privacy Policy | Contact us

| Advertise| Request For Music | Terms Of Service

9jaflaver is not responsible for the content of external sites.