It is quite embarrassing that the finance ministry and the Central Bank of Nigeria (CBN) are at

loggerheads over the management of the foreign exchange market. It started when finance minister,

Kemi Adeosun, in Nigeria’s fiscal roadmap for 2017, disclosed plans to ditch a 16-month old policy

which prohibits importers of a list of 41 items from obtaining dollars at the official market.

The dollar embargo on these 41 items which range from steel sheets, palm oil and textiles to

toothpicks, was introduced by the CBN in August 2015 to curb imports and ease the pressure on

dollar demand. The policy came about as the country’s stock of foreign currency thinned due to a

decline in dollar inflow which was brought on by militant attacks on oil pipelines and decade-low oil

prices. Petrodollars account for 95 percent of Nigeria’s foreign exchange earnings, necessitating the

need for dollar-demand management to preserve scarce dollars.

Godwin Emefiele told reporters in September that the dollar embargo on the blacklisted 41 items,

which sought to manage dollar demand, was helping to reduce importation and drive appetite for

locally made goods. True, there has been a decline in imports this year. The naira depreciation and

fuel subsidy removal must take some credit for the decline.

In dollar terms, the National Bureau of Statistics (NBS) noted that imports fell 12.5 percent to $7.53

billion (N2.41 trillion) in the first nine months of 2016, from $8.61 billion (N1.68 trillion) in the

same period of 2015. Imports are currently at their lowest in at least 4 years, according to CBN

data.

Meanwhile, appetite for locally made goods has been rising, and a clear indication is the dramatic

jump in sales for indigenous palm-oil companies, Okomu and Presco, which can thank the dollar

restriction and a naira devaluation for making them more competitive against their foreign

counterparts.

The CBN may be pleased with the outcome of its dollar restriction policy, but finance minister

Adeosun is having none of it; and rightly so. While the dollar restriction policy has been a boon for

the likes of Okomu and Presco, it has stifled growth for other indigenous manufacturing companies

and has thrown the entire sector into a recession. Maybe one tree cannot make a forest after all.

Frank Jacobs, chairman of the Manufacturing Association of Nigeria (MAN) said about 16 of the

total items on the list are critical raw materials for intermediate goods produced in the country.

Jacobs added that the dollar embargo led to the fold-up of about 272 manufacturing companies,

unable to sustain production due to exorbitant dollar costs at the parallel market.

So when Adeosun noted in the 2017 fiscal road-map that administrative measures on the list of 41

items will be replaced with fiscal measures, it became all too confusing.

It became even more confusing after Adeosun told reporters on Tuesday, December 21, that the CBN

will try to eliminate the spread between the official and black market exchange rate, without stating

how.

The naira exchanged at N305 for one US dollar at the interbank market on Wednesday, December 21,

while the parallel market recorded N490/$. Taking the spread between both markets to N185/$.

Maybe the finance minister had the dollar embargo suspension in mind when she said this.

By law, the CBN ought to seek approval from Adeosun to make decisions on foreign exchange and it

was because the ex-banker was not appointed till November 2015, that the dollar embargo policy of

August was not subjected to her approval.

It is believed that the disparity between the official market exchange rate and that of the parallel

market is fuelled by the blacklisted items, whose importers have turned to an alternative market to

meet their dollar needs. It is riding the official market of dollar liquidity and undermining efforts to

put Nigeria’s dollar crisis to bed, although the CBN’s price manipulation is the biggest elephant in

the room.

Increasing the tariff on the importation of these 41 items has often been put forward as a fiscal

measure to curtail imports, but maybe the naira depreciation should be trusted enough to discourage

appetite for imported items rather than imposing any form of regulation. Beyond dollar-demand

management, Nigeria must do more to boost the dollar supply side of the FX market.

Nigeria can learn from Egypt, which has allowed its currency, the Egyptian pound, to weaken, going

on to attract about $5 billion within one week. The largest economy in North Africa secured $2

billion in financing from international banks, and $2.75 billion first-tranche IMF loan worth $12

billion. The Egyptian pound (EGP) went from the second most expensive currency in emerging

markets to the third weakest, crashing 62.5 percent to 13/$ from 8/$ after officials floated the local

currency.

The float had become necessary to put a lid on an unofficial exchange rate growing in leaps and

bounds, touching a record high of 18/$1 in October, and gave a life-line to Egyptian businesses hard

pressed by acute dollar shortages. The black market has since disappeared as the weak pound,

which traded at 19.2/$ as at Wednesday, December 21, snuffs out arbitrage opportunities.

Nigeria attracted commendations when on June 20, it allowed the naira weaken against the dollar.

However, it has since rolled back on the policy. The immediate implication of a float may be dire but

it has proven a better option than a hard peg in the long term like in Russia and Kazakhstan.

The economic recovery in Russia and Kazakhstan now contrasts with the continuing slump in

Nigeria, suggesting both Russia and Kazakhstan were right to let their currencies move in line with

the oil price back in 2014. The currency peg in Nigeria is a deterrent to foreign investors, which the

former must attract to rejig its bleak economy.

An expansionary N7.2 trillion budget for 2017, which comes to a paltry 6.7 percent, is no solution to

growth in Africa’s most populous nation. Our budget to GDP ratio compares poorly with South-

Africa’s 20.7 percent.

The finance ministry and the CBN must sheathe their swords and agree on policies needed to take

the country’s economy, headed for its first full year contraction in 25 years, out of the rot it is stuck

in.

SPONSORED LINKS

[TRENDING SONG!!] Romani D-Fans – Bestie (Prod By Krizbeatz)

[TRENDING MIXTAPE!!] DJ Baddo – Bestie Unlimited Mix

[TRENDING SONG!!] TYSG Ft Bad Mz X Kendi Rozzi – Iyariya

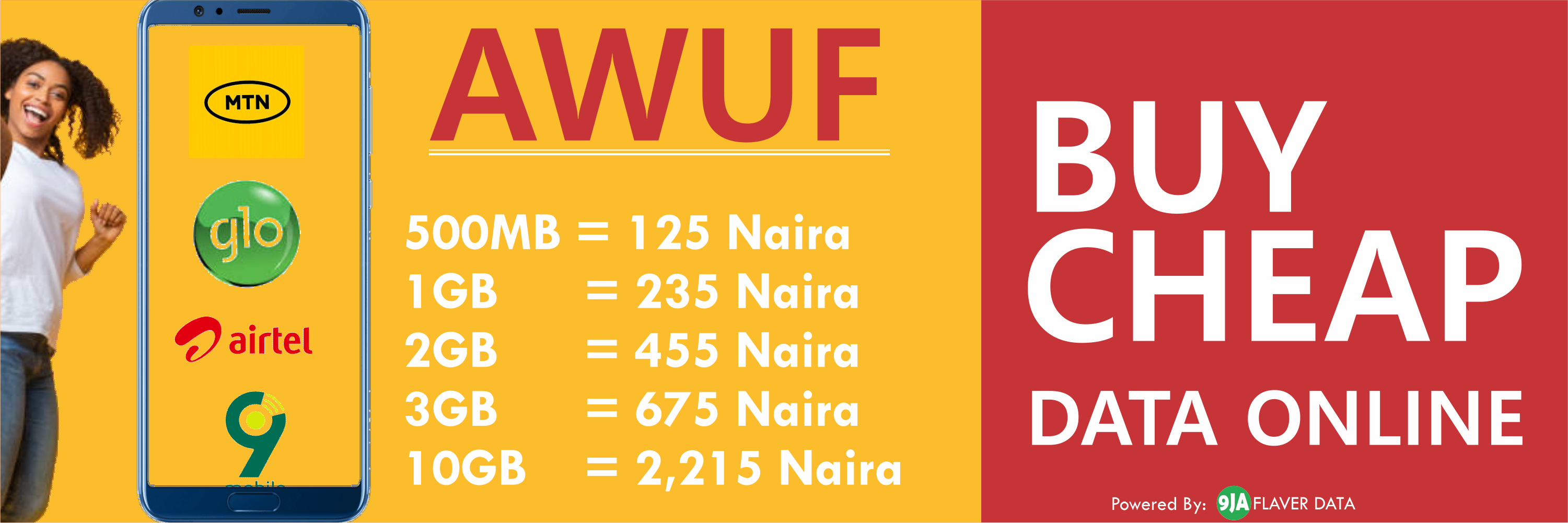

INSTALL 9JAFLAVER MUSIC APP, STREAM, DOWNLOAD, AND PLAY MUSIC OFFLINE

CHECK OUT FUNNY PICTURE AND MEME HERE (CLICK HERE)

Chissom Anthony – Glory To God In The Highest [See Trending Gospel Song]

© 2014-2023 9jaflaver. All Rights Reserved.

About us | DMCA | Privacy Policy | Contact us

| Advertise| Request For Music | Terms Of Service

9jaflaver is not responsible for the content of external sites.