Naira Falls To N350/$ As Investors Await Flexible Forex Policy

The Nigerian equities market appreciated to about five-month high wednesday as positive sentiments continued to trail the Central Bank of Nigeria’s (CBN) plan to introduce a flexible foreign exchange policy.

But feeling that the economy was regressing, the Senate yesterday summoned the Minister of Finance, Mrs. Kemi Adeosun, and the CBN Governor, Mr. Godwin Emefiele, to brief it on the monetary and fiscal policies the executive arm had adopted to salvage the economy.

In the equity market, however, the Nigerian Stock Exchange (NSE) All-Share Index surged 3.8 per cent to close at 28,260.61, while market capitalisation added N353.4 billion to be at N9.7 trillion. The market had gained 0.80 per cent on Tuesday when the decision was taken.

However, the naira dipped on the parallel market in reaction to the central bank’s pronouncement as it fell to N350 to a dollar yesterday, weaker than the N346 to a dollar it closed the previous day.

The Monetary Policy Committee (MPC) of the CBN announced on Tuesday that it voted unanimously to adopt a flexible exchange rate policy, while retaining a small window (from the CBN) for critical transactions. This, it said, would be made public in the coming days.

To analysts at Lagos-based CSL Stockbrokers Limited, the move by members of the MPC appeared to be a formalisation of the parallel market, adding that it was in line with what they had been expecting for the currency.

Its report said: “The flexible interbank exchange rate is likely to be far lower than the rate at which the CBN has been selling dollars to banks. We think this rate is initially likely to be around the current parallel market rate of N340/US$1 as pent-up demand for hard currency is released onto the market.

“Over time, the move is likely to increase the supply of US$ liquidity to the interbank market as remitters and exporters are likely to be more willing to sell dollars at the lower interbank rate. Similarly, we believe that investors who have been sitting on the sidelines for fear of not being able to get hard currency out of the economy will now be more willing to commit. With this increased supply, we expect that the flexible interbank market rate will gradually appreciate towards N310-N320/US$1.

“Overall this greater flexibility will be positive for the economy as it will improve access to foreign exchange (albeit at a higher rate) for firms which have been struggling to buy hard currency. The inflationary impact, we believe, will be fairly limited because many importers who were accessing dollars were already doing so on the inefficient parallel market.”

On their part, analysts at Ecobank Nigeria Limited pointed out that while it might be difficult to fully dimension the full impact of the expected adjustment in the operation of the interbank foreign exchange market, they opined that the flexible interbank exchange rate was likely to be above the current rate of $1/N197, at which the CBN had been selling dollars to banks.

They predicted that the expected currency adjustment would be around the current parallel market rate of N340/US$1 as pent-up demand for dollar was released onto the market.

“The effectiveness of this policy is likely to depend on the size of the allocation to ‘critical sectors’ (as well as the sectors that fall into this category) and the amount that is left available for the newly-autonomous interbank market. The system could be open to abuse. However, this opportunity to roundtrip is not new and has been available under the system that was in place until today’s announcement,” Ecobank analysts said.

But the Managing Director/Head of Research for Africa at Standard Chartered Bank, Razia Khan, in a note to THISDAY, pointed out that markets dislike uncertainty, and urged the central bank not to delay the announcement of the policy change.

According to him, “The talk of maintaining a small window for transactions for critical sectors is a concern. Any two-tier forex rate would still introduce a distortion in the system, and even with the best will in the world, still encourage round-tripping. If support were to be given to critical sectors, it would be far better to find a less-distortionary means of doing so.”

Analysts at Renaissance Capital in a note yesterday, stated that the ideal scenario would be for the central bank to let the market set the new interbank forex rate without restriction, and in so doing, allow for an appropriate level to be found.

They said: “We think this is somewhere between the fair values suggested by our two real effective exchange rate models – N255/$1 and the longer dated one, at N315/$1. At this new price for the naira, demand and supply would be brought into equilibrium through a decrease in forex demand (rationing effect) and increase in forex supply (the incentive effect).

“This would imply short-term pain, not least because of the inflationary effect, and high interest rates. But we believe decent growth would return, particularly given the low base effect.

“We believe the central bank may set a ceiling for the interbank forex rate, or specify a band within which the naira may trade. If the ceiling or band proves to be too low, say N240/$1, only limited forex liquidity will come into this market, and the interbank forex rate would soon hit the ceiling, or weak end of the band.”

Source:- thisdaylive

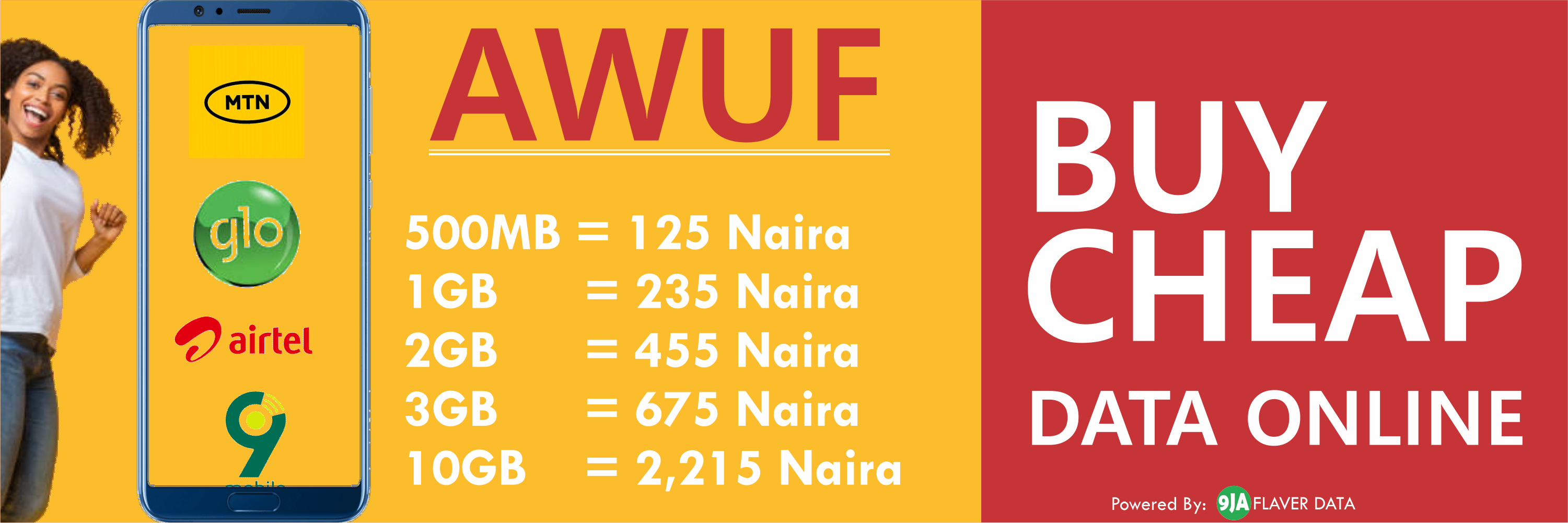

SPONSORED LINKS

[TRENDING SONG!!] Romani D-Fans – Bestie (Prod By Krizbeatz)

[TRENDING MIXTAPE!!] DJ Baddo – Bestie Unlimited Mix

[TRENDING SONG!!] TYSG Ft Bad Mz X Kendi Rozzi – Iyariya

INSTALL 9JAFLAVER MUSIC APP, STREAM, DOWNLOAD, AND PLAY MUSIC OFFLINE

CHECK OUT FUNNY PICTURE AND MEME HERE (CLICK HERE)

Chissom Anthony – Glory To God In The Highest [See Trending Gospel Song]

© 2014-2023 9jaflaver. All Rights Reserved.

About us | DMCA | Privacy Policy | Contact us

| Advertise| Request For Music | Terms Of Service

9jaflaver is not responsible for the content of external sites.