Naira Gains As Nigeria’s Central Bank Boosts Dollar Supplies – Bloomberg

Naira Gains as Nigeria’s Central Bank Boosts Dollar Supplies

Foreign investors yet to make a return, says SCM Capital

Central bank’s interventions set to continue, says RMB

Nigeria’s naira strengthened against the dollar, heading for its first gain since starting to trade without a peg three days ago, as the central bank sought to stabilize the market by selling dollars.

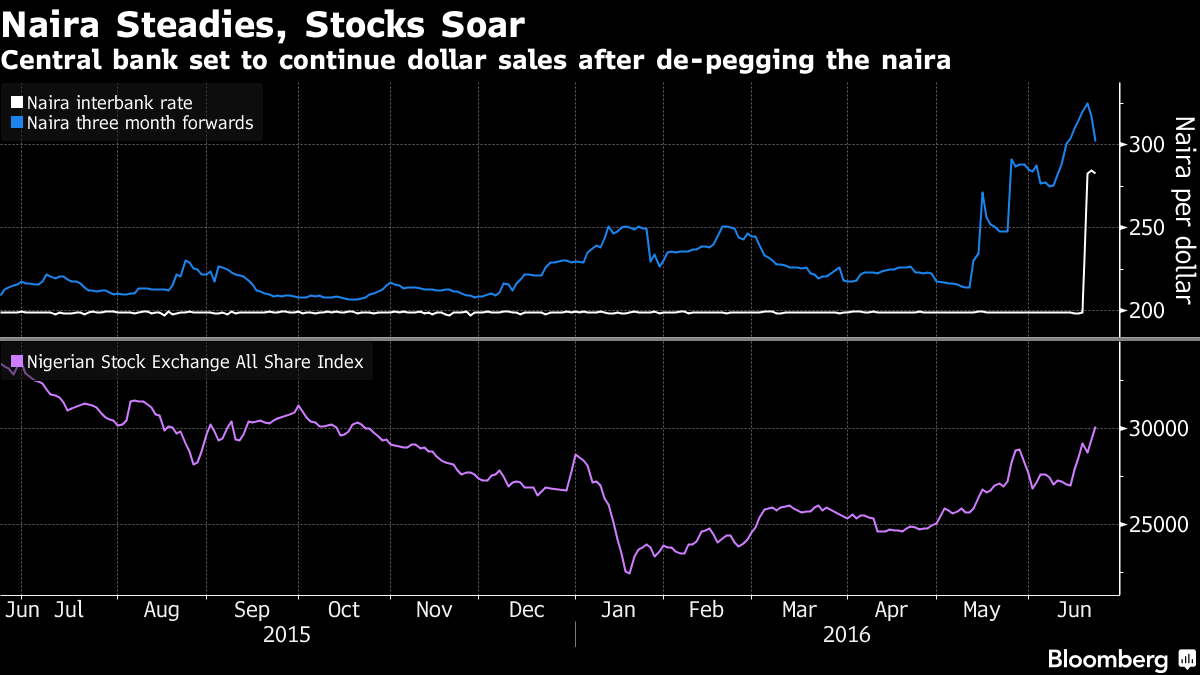

The naira rose 0.7 percent to 282.5 per dollar by 5 p.m. in Lagos, the commercial capital of Africa’s largest economy, after earlier dropping as much as 0.5 percent.

The regulator has intervened in the market by selling foreign exchange since it ended the currency’s 16-month fix of 197-199 per dollar on Monday. It sold $4 billion in the spot and forwards markets that day to clear a backlog of demand for hard currency, and followed that with about $100 million of sales on the spot market on Tuesday.

“The market expects the central bank to continue to intervene on a daily basis for now as it is easily the only source of dollar supplies,” Sewa Wusu, head of research at SCM Capital Ltd., said by phone from Lagos. “Foreign direct investment and portfolio flows are yet to start flowing in as investors wait on the sidelines to watch for liquidity, price discovery and stability.”

Forward contracts dropped as traders reduced their bets on how much further the naira will weaken, although they still see it dropping 6.5 percent by late September. Three-month naira non-deliverable forward contracts fell 4.7 percent, the most on a closing basis since May 17, to 302.25 per dollar. Contracts maturing in a year declined 3.7 percent to 340 per dollar.

“The monetary authority will be a regular participant in the interbank market, at least in the short term, to ensure that sufficient liquidity is available to facilitate two-way trade,” analysts at Johannesburg-based Rand Merchant Bank, including Celeste Fauconnier and Nema Ramkhelawan-Bhana, said in a note to clients.

Nigeria’s benchmark equity index rose for a second day, advancing by 2.4 percent to 30,127.82, its highest close since Oct. 21. It has soared 34 percent since falling to a more than three-year low on Jan. 19, as local investors buy stocks anticipating a return by foreigners, who fled when the central bank imposed capital controls to defend the naira’s peg.

Yields on the West African country’s $500 million bonds due in July 2023 were little changed at 7.09 percent.

They’ve dropped 51 basis points since central bank Governor Godwin Emefiele announced on June 15 that he was ending the currency fix.

Source:- Bloomberg

Now Playing: Love Bug

Aretti Adi

SPONSORED LINKS

LOAN FOR TRAVEL, VISA, JAPA, PoF UP TO N200M (CLICK HERE)

[CLICK HERE] For Music Artwork, Website Design And SEO Setup

INSTALL 9JAFLAVER MUSIC APP, STREAM, DOWNLOAD, AND PLAY MUSIC OFFLINE

CHECK OUT FUNNY PICTURE AND MEME HERE (CLICK HERE)

Chissom Anthony – Glory To God In The Highest [See Trending Gospel Song]

Copyright © 2014-2025 9jaflaver. All Rights Reserved.

About us | DMCA | Privacy Policy | Contact us

| Advertise| Request For Music | Terms Of Service

9jaflaver is not responsible for the content of external sites.