CBN Sells $100m As Naira Pulls Back From Record Low – Bloomberg

Nigerian CenBank Sells $100m as Naira Pulls Back From Record Low – Bloomberg

Nigeria’s naira gained on its second day of trading without a peg after the central bank again intervened in the market by selling dollars.

The central bank sold around $100 million in the interbank spot market on Tuesday, according to spokesman Isaac Okorafor. That followed an auction of $4 billion on Monday — when the naira slumped 30 percent after the central bank abandoned its peg. Stocks gained, while yields on Nigeria’s Eurobonds fell to 10-month lows.

“It’s our estimate” that the bulk of the backlog of orders has been met, Okorafor said by phone from Abuja, the capital. “We’re very optimistic that liquidity in the FX market will improve. Whether we decide to intervene again depends on the dynamics.”

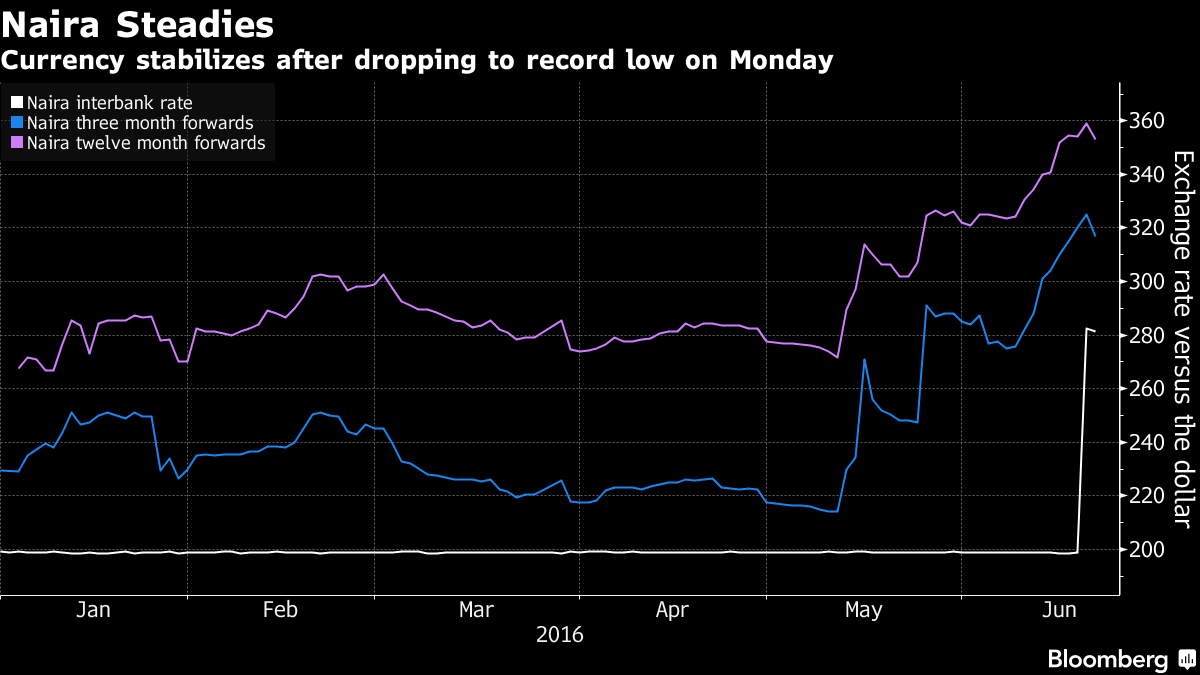

The currency of Africa’s biggest economy strengthened 0.4 percent to 281.5 per dollar by 6:33 p.m. in Lagos, the commercial capital, after declining as much as 1.4 percent earlier to a record 286.5. A currency peg of 197-199 had been in place since March 2015.

The central bank sold $532 million on the spot market and $3.49 billion on the forwards market on Monday, Lagos-based foreign-exchange trading platform FMDQ OTC Securities Exchange said on its website. While the exchange rate for the forwards wasn’t disclosed, the dollars on the spot market were sold at a rate of 280 naira per dollar, according to a person who asked not to be identified as the information isn’t public.

“Given the quantum that was cleared at this point, this will probably be viewed as a positive result,” Samir Gadio, head of Africa strategy at Standard Chartered Plc in London, said in an e-mailed response to questions on Monday. “That said, the pressure on foreign-exchange reserves is only likely to be deferred in the forward market. The Central Bank of Nigeria will also remain the main provider of dollar liquidity in the spot market for the time being.”

Stocks Advance

Nigeria’s benchmark stock index climbed 2.3 percent to 29,442.71, its highest close since Oct. 29 and reversing Monday’s 1.6 percent decline. GlaxoSmithKline Consumer Nigeria Plc climbed 10 percent, while Champion Breweries Plc rose 9.2 percent. Yields on the West African country’s $500 million bond due in July 2023 were little changed at 7.09 percent.

The central bank, which has seen its reserves dwindle over the past several years, will struggle to keep intervening on a large scale to defend the currency, according to UBS Wealth Management.

“They can’t do this for months,” Jonas David, a Zurich-based emerging-markets analyst at UBS Wealth Management said Monday. “We could see further pressure on the naira” and it may depreciate to about 300 per dollar, he said.

Further Declines

Traders are betting the naira will further weaken by more than 10 percent by September. Three-month naira non-deliverable forward contracts fell 2.5 percent to 317 on Tuesday, while one-year contracts dropped 1.7 percent to 353.

Governor Godwin Emefiele said when he announced a float of the currency on June 15 that the monetary authority would intervene when necessary even though it was allowing the exchange rate to be “market-driven.”

The CBN introduced capital controls to stem an outflow of dollars after the naira crashed to a then-record of 206.32 in February 2015 as oil prices slumped. While stabilizing the naira, the controls deterred foreign investors and starved manufacturers of hard currency needed to pay for raw materials and equipment. Nigeria’s gross domestic product contracted in the three months through March for the first time since 2004 and inflation accelerated to an almost six-year high of 15.6 percent in May.

Source:- bloomberg

Now Playing: Love Bug

Aretti Adi

SPONSORED LINKS

LOAN FOR TRAVEL, VISA, JAPA, PoF UP TO N200M (CLICK HERE)

[CLICK HERE] For Music Artwork, Website Design And SEO Setup

INSTALL 9JAFLAVER MUSIC APP, STREAM, DOWNLOAD, AND PLAY MUSIC OFFLINE

CHECK OUT FUNNY PICTURE AND MEME HERE (CLICK HERE)

Chissom Anthony – Glory To God In The Highest [See Trending Gospel Song]

Copyright © 2014-2026 9jaflaver. All Rights Reserved.

About us | DMCA | Privacy Policy | Contact us

| Advertise| Request For Music | Terms Of Service

9jaflaver is not responsible for the content of external sites.